property tax bill las vegas nevada

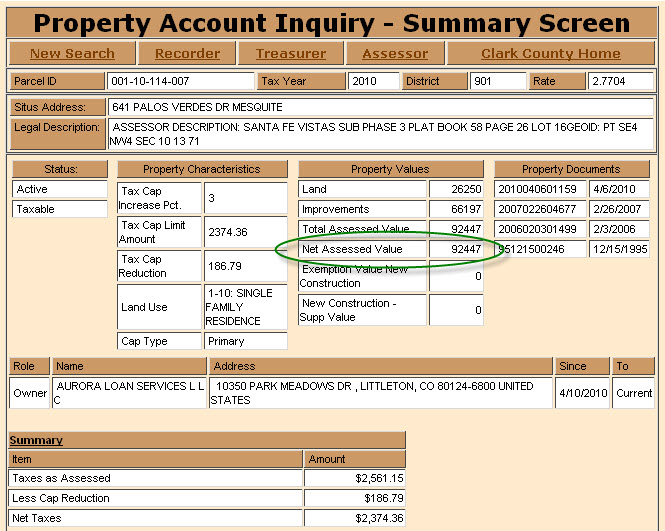

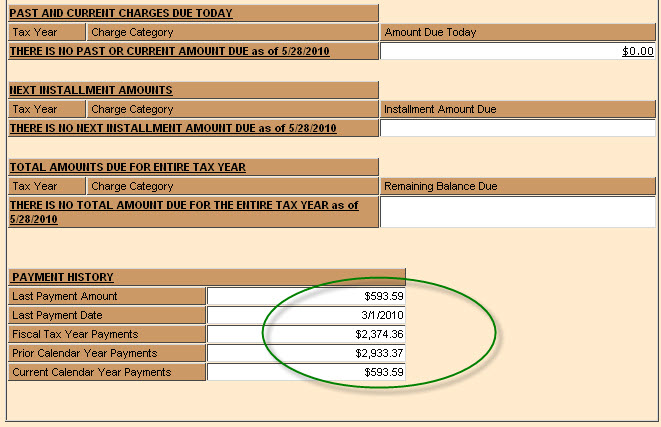

The assessed value is equal to 35 of the taxable value. The appeal form must be obtained from the county assessor and filled out completely in Clark County call 702 455-3891.

Clark County Property Taxes Misinformation Addressed By Assessor Las Vegas Review Journal

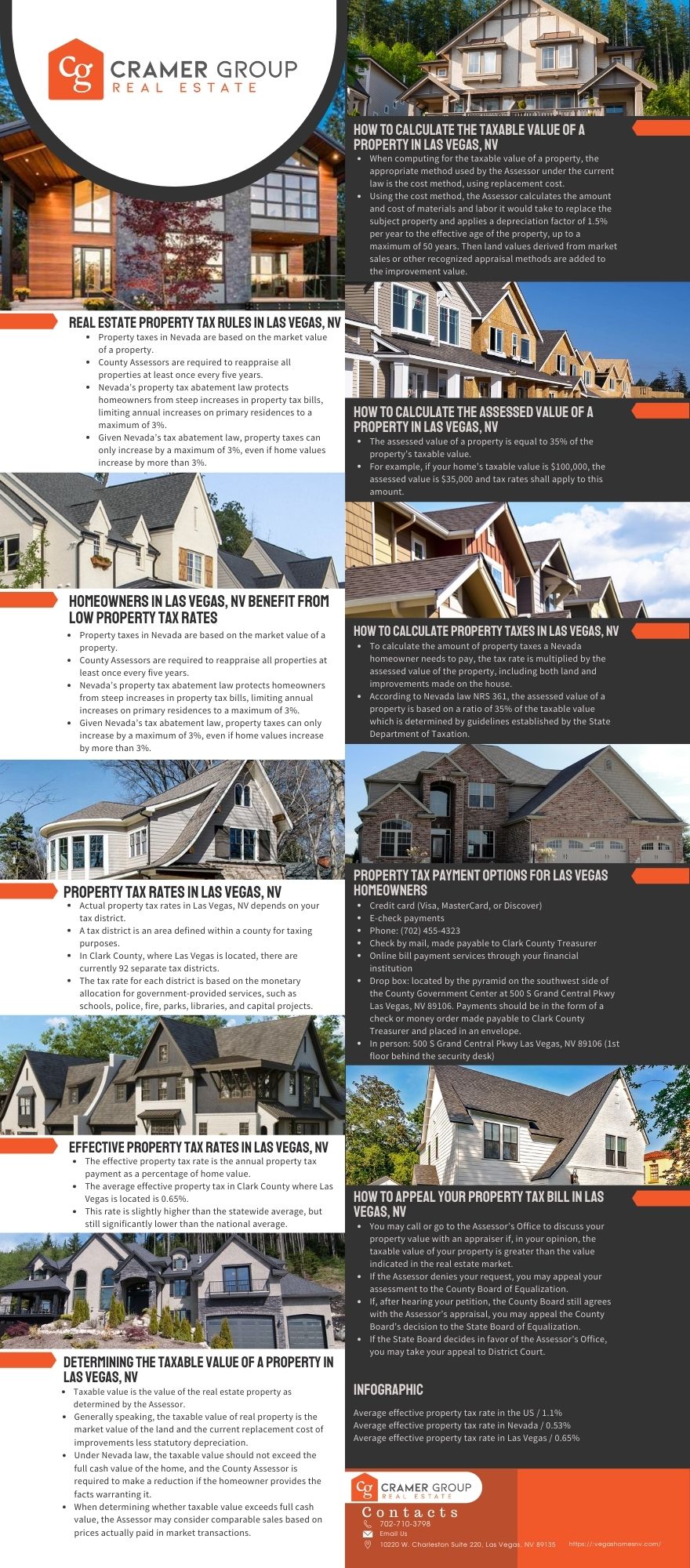

Homeowners in Nevada are protected from steep increases in.

. In Nevada the market value of your property determines property tax amounts. South Las Vegas Nevada TeleFax. Facebook Twitter Instagram Youtube NextDoor.

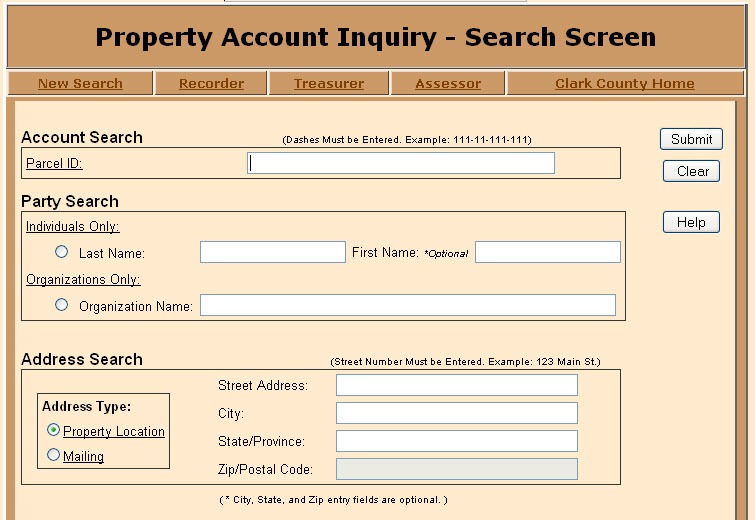

If you do not receive your tax bill by August 1st each year please use the automated telephone system. Ad Get Records Retrieval For Nevada Tax Today. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

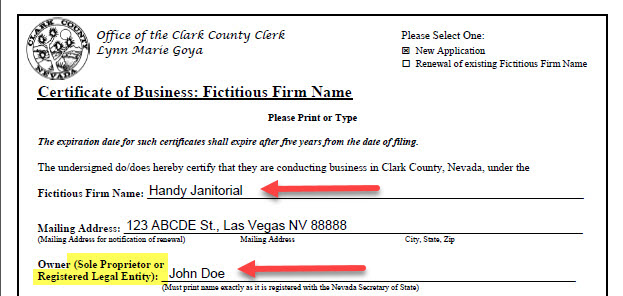

The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000. Apply for a Business License. What was once the old Dunes Golf Course running.

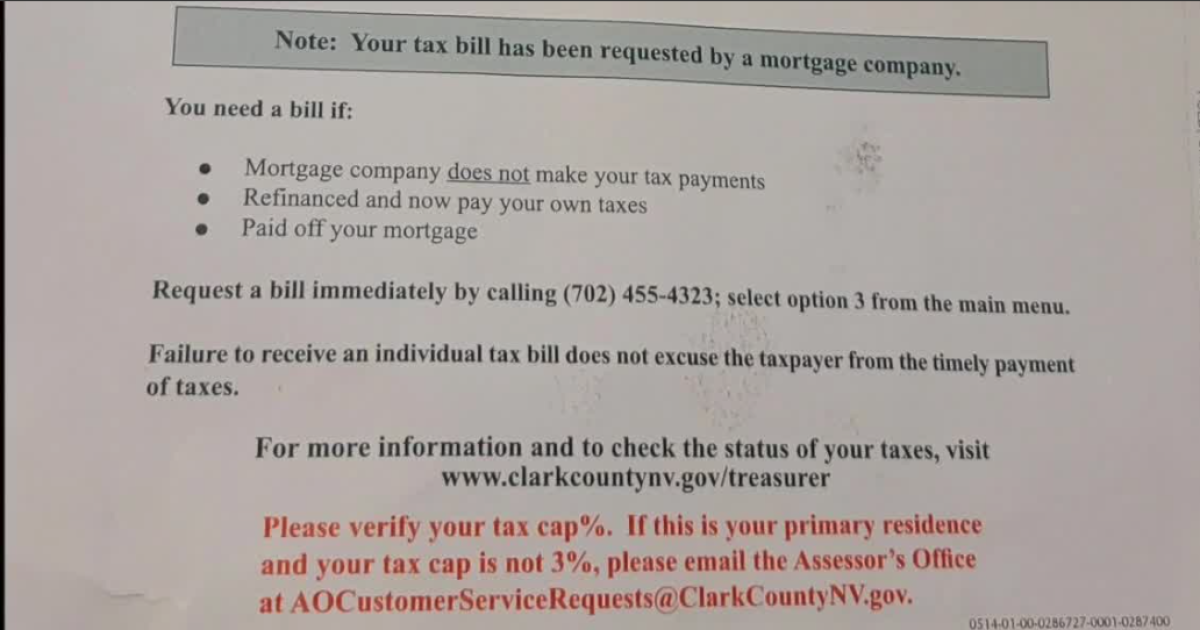

They must be paid on time in order to avoid penalties. Treasurer - Real Property Taxes. The initial real property tax bills for Clark County residents were mailed over the weekend and should be arriving in mailboxes as early as this week according to a county news.

18 2022 at 242 PM PDT. Visit Our Website For Trustable Records. A composite rate will produce expected total tax receipts and also.

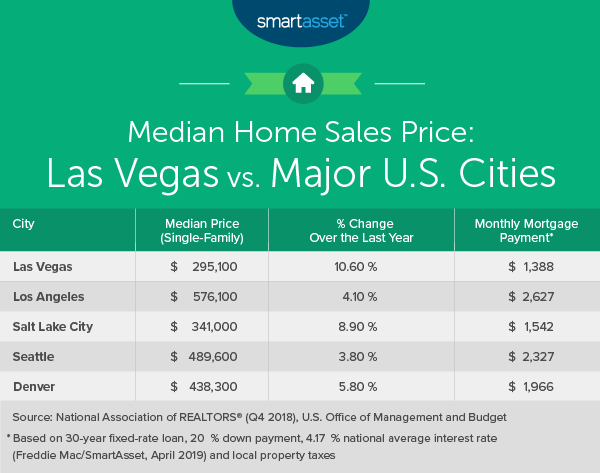

Search Homes Our Team Our Agents Las Vegas Communities Housing. Be prepared to provide the parcel ID number. With market values established Las Vegas along with other in-county public districts will calculate tax levies alone.

All Major Categories Covered. Las Vegas Nevada 89155-1220. You can expect to see property taxes calculated at about 5 to 75 of the homes purchase price.

Tropicana Suite 710-U Las Vegas NV 89119 Copy of Complete Jockey Club Alliance Deed 11 Pages - 15000. Get Accurate Las Vegas Records. 3700 Las Vegas Blvd.

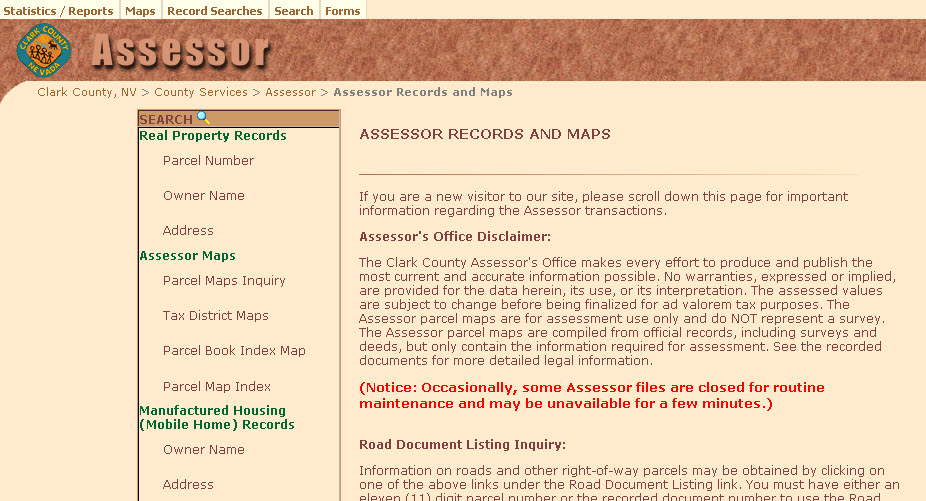

Fast Easy Access To Millions Of Records. One cost that is often overlooked is property tax. The following FAQs answer key questions about.

In Clark County Nevada property tax rates are among the lowest in the. Ad See Anyones Public Records All States. The states average effective property tax rate is just 053.

Las Vegas Property Taxes - how to calculate property taxes in Nevada and how to learn more. The Treasurers office mails out real property tax bills ONLY ONE TIME each fiscal year. Supplemental tax bills are separate from and in addition to the annual secured property tax bill.

Make Personal Property Tax Payments. Select Popular Legal Forms Packages of Any Category. IF I PAY TAXES THROUGH AN.

Compared to the 107 national average that rate is quite low. FOX5 - Clark County mailed out initial real property tax bills over the weekend following a frenzy of residents. Make Real Property Tax Payments.

Thus if the Clark County Assessor determines your homes taxable value is 100000 your assessed value will be. Checks for real property tax payments should be made payable to Clark County Treasurer. To ensure timely and accurate.

Type Any Name Search Risk-Free. Counties in Nevada collect an average of 084 of a propertys assesed fair. 02 Jockey Club Property Tax Bill Clark County Nevada.

6 Facts Every Homeowner Should Know About Property Taxes Las Vegas Review Journal

Nevada Homeowners May Be Paying More On Property Taxes

Be Sure To Lower Your Property Tax By Filing A Primary Residential Tax Cap Claim Ksnv

Mesquitegroup Com Nevada Property Tax

Las Vegas Homeowners Rushed To Assessor S Office To Beat Tax Cap Deadline

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Mesquitegroup Com Nevada Property Tax

Mesquitegroup Com Nevada Property Tax

/cloudfront-us-east-1.images.arcpublishing.com/gray/X3V2BLFPWFD7JBZ5EHJ2AQMNIA.jpg)

Clark County Clarifies Deadline For Homeowners To Update Info To Avoid Higher Property Tax Rate

Be Sure To Lower Your Property Tax By Filing A Primary Residential Tax Cap Claim Ksnv

The Cost Of Living In Las Vegas Smartasset

Nevada Is The 9 State With The Lowest Property Taxes Stacker

Mesquitegroup Com Nevada Property Tax

Be Sure To Lower Your Property Tax By Filing A Primary Residential Tax Cap Claim Ksnv

Understanding Your Residential Bill

In Clark County One Postcard Could Mean You Re Paying More Property Taxes Than You Realize Nevada Public Radio